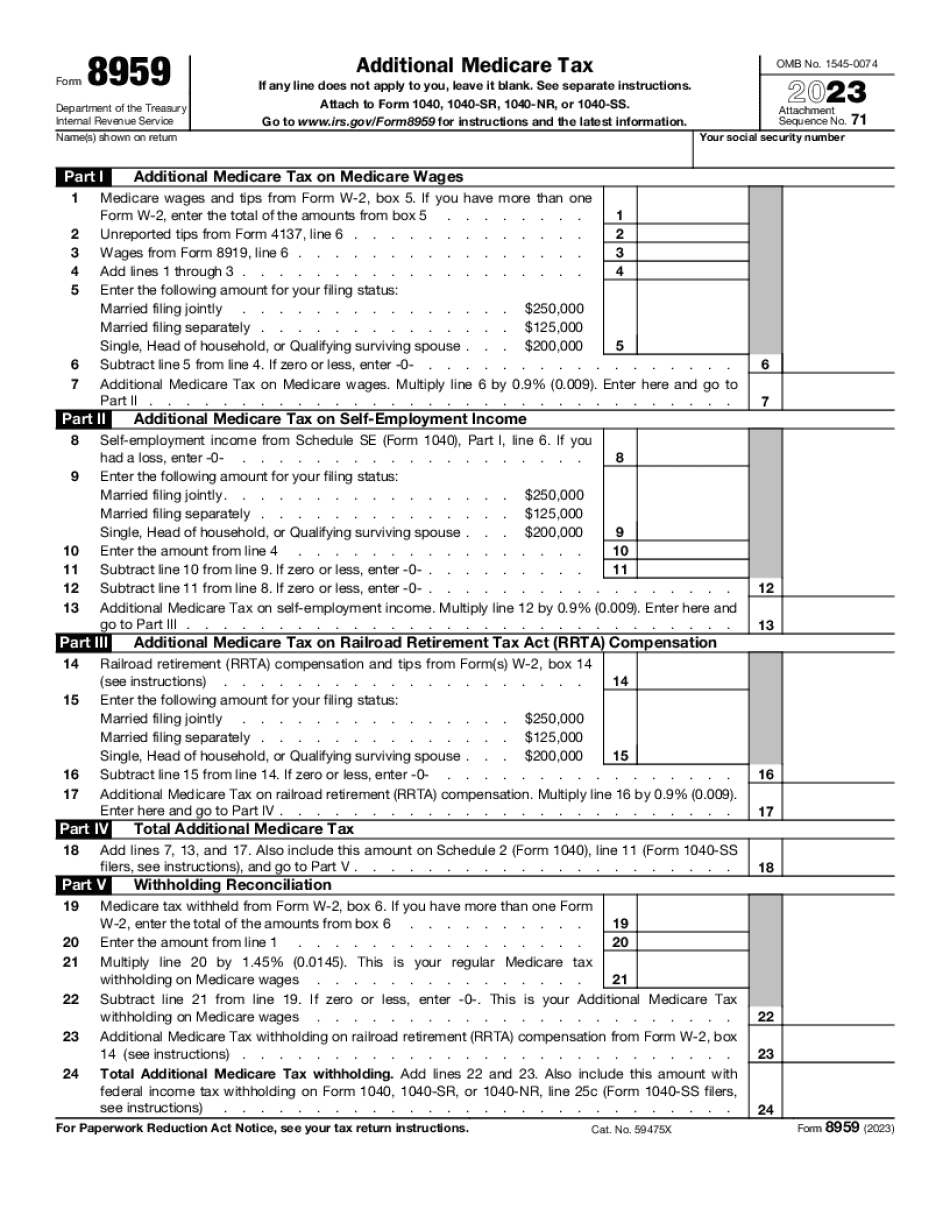

Starting in 2013, you may be liable for an additional Medicare tax if your income exceeds certain limits. Here are six things that you should know about this tax: 1. The additional Medicare tax is 0.9 percent and applies to the amount of your wages, self-employment income, and railroad retirement compensation that exceeds a specific threshold amount. 2. The threshold amount depends on your filing status. If you are married and file a joint return, you must combine your spouse's wages, compensation, or self-employment income with yours to determine if you exceed the married filing joint threshold. 3. Here are the thresholds for different filing statuses: - Married filing jointly: $250,000 - Married filing separately: $125,000 - Single: $200,000 - Head of household: $200,000 - Qualifying widower with a dependent child: $200,000 4. To determine if your income exceeds the threshold, you must combine your wages and self-employment income. Loss from self-employment is not considered when calculating this tax. 5. If your employer pays you more than $200,000 in a calendar year, they are required to withhold this tax from your wages or compensation, regardless of your filing status. This tax is not combined with wages from a different employer or income from other sources for married couples. 6. Depending on your filing status and other income, you may owe more tax than the amount withheld. In such cases, you should make estimated tax payments or request additional income tax withholding using form W-4. If you didn't pay enough estimated taxes, you may owe an estimated tax penalty. Form 8959 should be filed with your tax return to report this tax, and you can also report additional Medicare tax withheld from your employer on Form 8959. If you need assistance with calculating or understanding this complex tax, feel free to reach out to us for...

Award-winning PDF software

Additional Medicare Tax withholding 2024 Form: What You Should Know

Aug 18, 2024 — Schedule A of Form 1040 or Form 1040A includes the Additional Medicare Tax on wages. The Additional Medicare Tax applies only to wages and tips from Form W-2, box 5. If you have more than one. Form 1040 or Form 1040A — Additional Medicare Tax Returns — Internal Revenue Service Aug 29, 2024 — If your Additional Medicare Tax on Social Security wages exceeds 0.5% of your wages, then the Additional Medicare Tax is 0.04%. If you have more than one. Form 1039, Additional Medicare Tax Return — United States Postal Service In general, any person with a Social Security number must pay the Additional Medicare Tax. Social Security wage base amounts for 2024 will be based on a calculation of the number of hours you worked that month, with wages from Form W-2 included in the calculation. See Social Security wages from What Is Form W-2, Box 5 On Form 1040 or on Schedule A? In summary, this tax form is a record of all you earned by check, money order, or electronic fund transfer, as well as all cash wages and other compensation you received from wages on which Social Security tax was not withheld. This tax form is used to report all wages and other cash compensation from wages, tips, wages from self-employment income, and other amounts on Form 1040 and Forms 1040A. These forms are also useful for reporting wages and other compensation from other types of transactions. For example, Form 1040A will be used to report wages from your business, as well as other amounts you received, from rental of property, and from insurance policies and annuities. Form 1040, with Schedule A, may be submitted when you file your individual income taxes. For each of your wages and other cash compensation from which you are not entitled to receive a Social Security tax deduction, you must submit a separate form to the IRS. It usually takes 1-5 business days to process Form 1040 or Schedule A. If you have any questions, contact the Revenue Officer. How Does Medicare Tax Affect Employment And Tax Return Forms? The Medicare tax penalty (0.94%) applied to a taxpayer's compensation from wages which do not exceed the Medicare tax threshold. Thus, for wages not exceeding 200,000 in any quarter the minimum amount of Medicare tax is 5.15%. See the chart above — What Does Minimum Amount Of Medicare Tax Cost? .

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Steps to Fill out Digital 8959 , steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Steps to Fill out Digital 8959 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Steps to Fill out Digital 8959 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Steps to Fill out Digital 8959 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Additional Medicare Tax withholding 2024