Hello students in this video we will discuss in details step by step the registration process for ECS NAD what twenty20 match before starting with the registration process I will first clear some of the common doubts which more students are facing that is what is PCs NP what is ninja what is digital so let us understand this first so last year TC and started taking national level tests for its recruitment process and these national level tests are known as NP that is national qualifiers test okay, so the two words basically do ninja and digital okay these both are nothing but the job profiles you can see okay, so there are two job profiles which TCS offers, and it offered last year also, so a ninja is one job profile and another one is diluted the package in Ninja is offered around 3.

PDF editing your way

Complete or edit your form 8959 form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form 8959 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form medicare tax as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 2016 form 8959 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

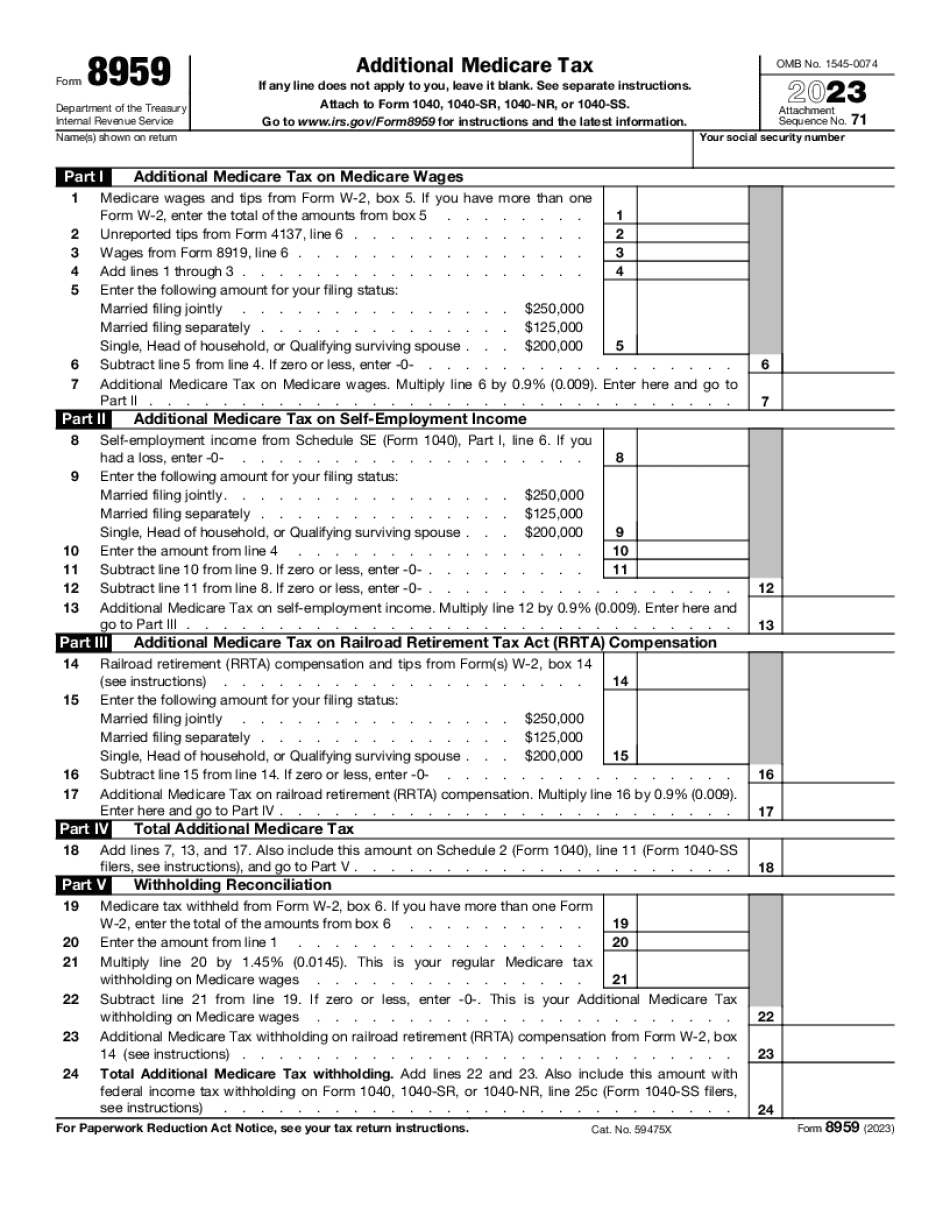

What you should know about Form 8959

- Form 8959 is used to calculate Additional Medicare Tax.

- Form 8959 is required to be filed with Form 1040, 1040-SR, 1040-NR, or 1040-SS.

- The form includes sections for withholding reconciliation and self-employment income.

Award-winning PDF software

How to prepare Form 8959

About Form Steps to Fill out Digital 8959

Form 8959 is used to calculate and report the Additional Medicare Tax that is owed by certain individuals. This tax of 0.9% is imposed on wages, salaries, and self-employment income that exceed certain thresholds. It is intended to help fund the Medicare program. If you earn wages, salaries, tips, bonuses, and/or commissions and meet one of the following criteria, you will need to use this form: - You are a single taxpayer and your wages, etc. exceed $200,000. - You are joint filers and your combined wages, etc. exceed $250,000. - You are married filing a separate tax return and your wages, etc. exceed $125,000. To fill out Form 8959, follow these steps: 1. Enter your name and Social Security number at the top of the form. 2. Determine if you are subject to Additional Medicare Tax based on your income and filing status. 3. Calculate the Additional Medicare Tax owed using the worksheet on the form. 4. Enter the total tax owed on your tax return or request for an extension. 5. File the form with your tax return or extension request. It is important to note that this form is only applicable for tax year 2024 and prior. The Additional Medicare Tax is no longer in effect for tax year 2021.

How to complete a Form 8959

- Calculate and enter the Total Additional Medicare Tax

- Add lines 7, 13, and 17

- Include this amount on Schedule 2 Form 1040 line 11

- Select your filing status and enter the corresponding amount

- Subtract line 15 from line 14

- Enter the result

- Fill in the Selfemployment income from Schedule SE Form 1040 Part I line 6

- Proceed to Part III for further details on Medicare wages and tips from Form W2 box

People also ask about Form 8959

What people say about us

Video instructions and help with filling out and completing Form 8959