Everyone, Bill Lessman here for Money Evolution dot-com. Welcome back to another one of our daily live videos. We're broadcasting to you every weekday, Monday through Friday. So, this is actually episode number four. Last week, in episode two, I started to talk with all of you about what I referred to as the seven core elements of retirement planning. Each of these seven elements will play a part in your ultimate retirement goals and the things you want to accomplish in retirement. Some of these things include knowing how much your retirement is going to cost, identifying your gap, where to save money, what types of accounts will be best for your retirement dollars, deciding when to collect Social Security, healthcare costs, the 401k plan, and knowing how to unlock its full potential as you approach retirement. Starting to create a plan for income is also important. Finally, after going through each of these seven steps, we will discuss choosing your investments. Unfortunately, many people start with step number seven. In this video, I am going to expand on one of these seven elements and talk about where to save money. Specifically, I will discuss some of the tax implications of where you save money and how it might impact your retirement and the amount of money you have to spend during retirement. Let me clear this whiteboard here and do my best to cover this quickly. If you haven't already, click the like button on our page at Money Evolution to get notified of our updates. We are also planning a rebroadcast of these videos on our YouTube channel, which is approaching 200,000 views. So, if you prefer watching on YouTube, head over there and subscribe. You can also access the videos on moneyevolution.com. Now, let's talk about some tax strategies specifically...

Award-winning PDF software

Medicare surcharge tax on high-income taxpayers Form: What You Should Know

Net Investment Income Tax or Medicare Tax is imposed on earned investment income in excess of the threshold amount: Medicare's 3.8% Tax on Investment Income The threshold amount is defined under Section 1411; however, it only applies to taxable individuals who earn more than the threshold on taxable investment income. In general, investment income (other than retirement plan and annuity income) and capital gains are not taxed until a taxpayer's tax-filing period begins. The first taxable year that a taxable individual earns investment income in excess of the threshold will be the same as the tax-filing period immediately before the earning of the amount on which the additional income tax is calculated. Taxable Earnings: The Taxable Year of Withholding Most taxpayers filing their first 2024 income tax return during their tax-filing period are included in the taxable income of the taxpayer to whom the 3.8% tax is levied. For example, if an individual files a Form 1040A, that individual will be included in the 2024 tax return and will be liable for 3.8% tax on the adjusted gross income (AGI) in the 2024 tax return unless an exception applies. (An exception is provided below.) The taxable earnings of a taxpayer who does not file a Form 1040A or a Form 1040EZ are taxed in an additional manner. Capital gains and qualified dividends are taxed in the same manner as other income. For a summary of the capital gains portion of the 3.8% Medicare tax, please click here. Medicare Tax Exceptions The Medicare tax does not apply if any of the following conditions exist for the taxable year: You are a qualifying individual or a qualifying family member who met the qualifying threshold to claim the additional Medicare tax amount when you filed your income tax return for that year. Qualifying Individuals: Individuals who have a qualifying household size; Families: A family which includes more than one qualifying individual and is treated as a qualifying family for any tax year under the rules under section 1441; or Qualifying Trades: An individual who is, as a member of his or her own firm, or as a member of a partnership, or as a director of such a firm, employed as a chief financial officer of an active, qualified trade or business and is actively engaged in activities carried out in connection with or in furtherance of the active, qualified trade or business.

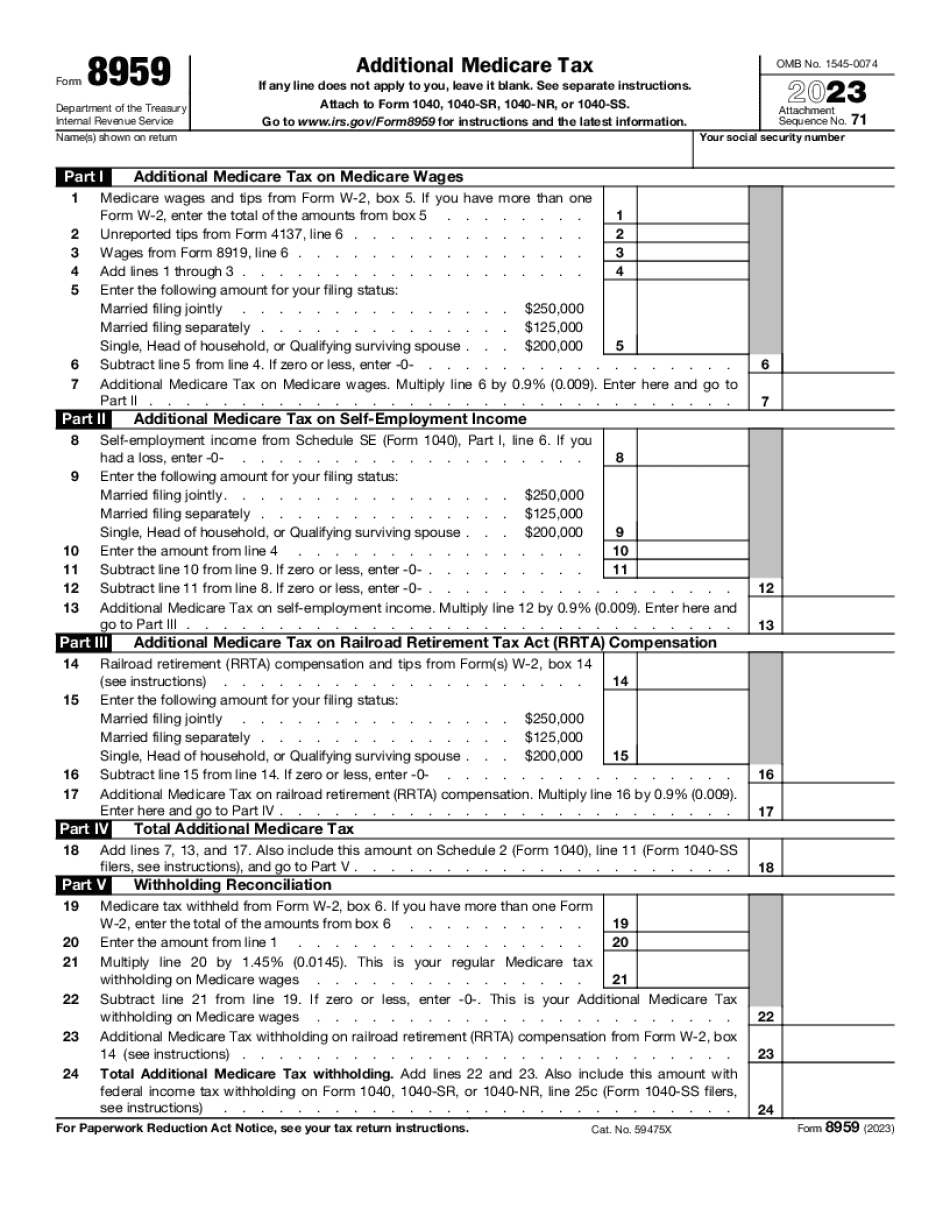

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Steps to Fill out Digital 8959 , steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Steps to Fill out Digital 8959 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Steps to Fill out Digital 8959 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Steps to Fill out Digital 8959 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Medicare surcharge tax on high-income taxpayers