Have you been researching Medicare Part D plans and feeling thoroughly confused about things like the deductible and the coverage gap? If so, you are in luck because in this video, I'll go over how Medicare Part D works and what the four stages of coverage are in every Part D plan. - Hi there! If we haven't met yet, I'm Danielle Roberts, Forbes finance council member, and co-founder here at Boomer Benefits, where we provide free Part D analysis each year for all of our Medigap and Medicare Advantage policyholders. - Although Part D drug plans are offered by private insurance carriers, each plan must meet federal guidelines. All drug plans have four stages, and Medicare sets the limits for each of these stages. - During the year, companies can offer benefits that are richer than the minimum standard but not less than that standard. - The four stages of Part D are the deductible, the initial coverage level, the coverage gap or doughnut hole, and catastrophic coverage. - Let's start with a deductible. The deductible is the amount that you pay out-of-pocket first each year on your medications before your co-pays kick in under your plan. Medicare sets the maximum deductible each year, and Part D insurance companies must keep their plan deductible at or below that number. - In 2019, the maximum deductible will be four hundred and fifteen dollars. Again, companies can waive that deductible or set a lower deductible, but they can't charge a higher deductible. - Here's how the deductible works: if your plan has a four hundred fifteen dollar deductible, you will pay out of your own pocket for your medications until you have spent that much and satisfied the deductible. For example, if you have a medication that costs a hundred dollars, when...

Award-winning PDF software

Why do i pay medicare tax Form: What You Should Know

Income tax forms have a bar code at the top that you can scan to get information from the form. When you scan the code on the form to get information, you are not asking for the form to be returned to you. Instead, you will get a link to the form on the site. You must take this link back to the IRS website to get the information that relates to your situation. For example, if you want to get the information for your health insurance in the form, but Medicare won't send you an information note for the health insurance, you don't need to take the form. You must take this back to the IRS website, so the information on the form can be seen and verified. This is why you must scan the information, as opposed to taking it all by hand. To scan the information, click the “PDF” symbol in the top-right corner of the form to print. To scan the information, you must choose the best screen resolution available. For example, if you have a 1280 × 768 screen, you must scan the form in 2 columns, with each column containing a single line of text. You get to scan multiple lines of information at the same time. You must either leave a blank line between the lines of information that you scan, or you must scan each line separately, and leave a blank line between lines.

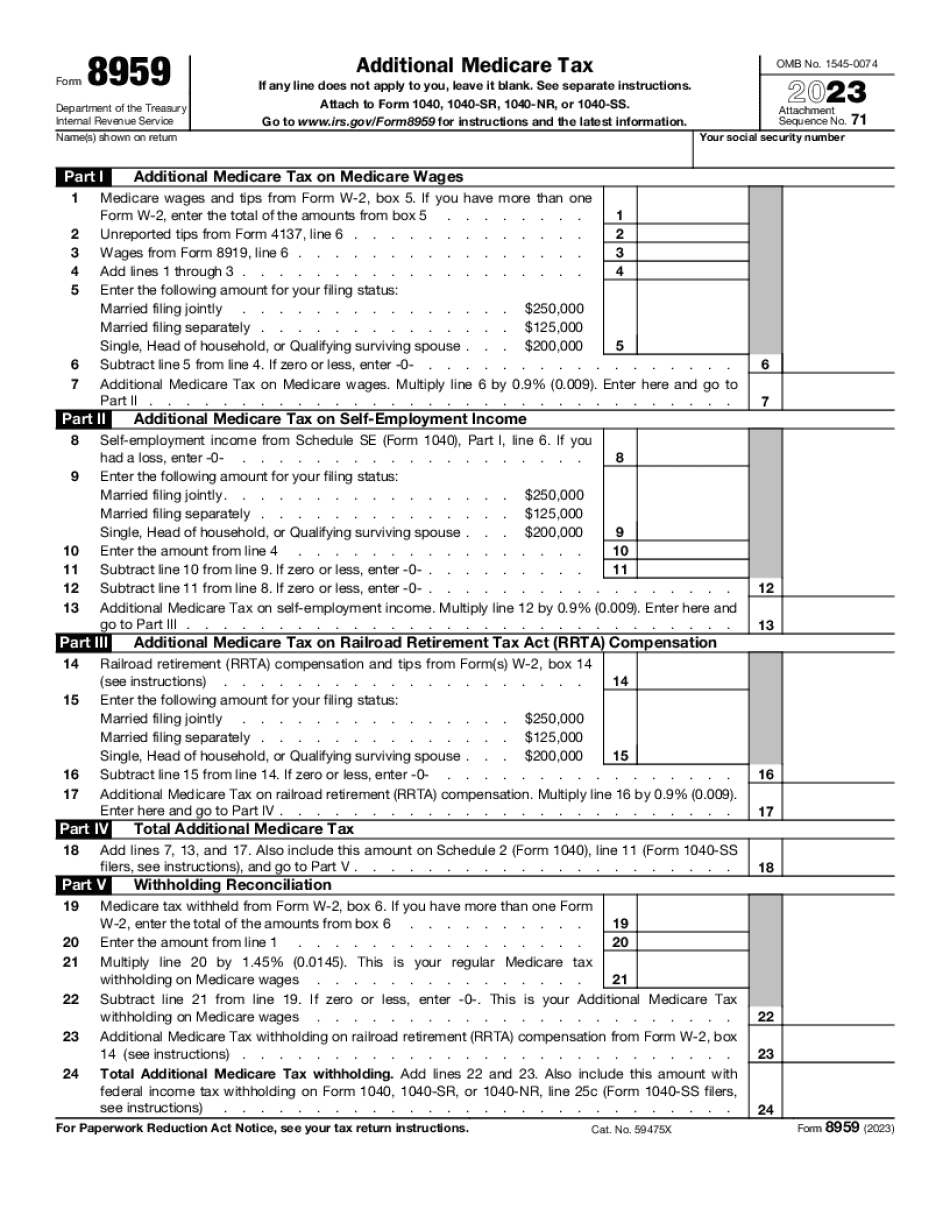

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Steps to Fill out Digital 8959 , steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Steps to Fill out Digital 8959 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Steps to Fill out Digital 8959 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Steps to Fill out Digital 8959 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Why do i pay medicare tax