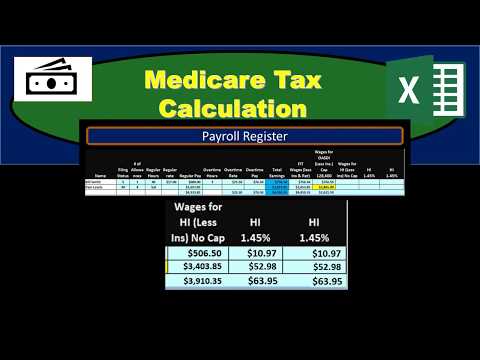

In this presentation, we will take a look at the calculation for Medicare tax. For more accounting information and accounting courses, visit our website at accountinginstruction.info. Here, we are on the payroll register and we have two employees, Bill and Pam. We have the regular pay, overtime pay, and the total earnings. When looking at the calculation for Medicare, we need to consider the earnings for Medicare which may differ from the total earnings. It's important to remember that the total earnings include both the regular pay and overtime pay. However, when calculating the payroll taxes, we may need to adjust the earnings. For example, the earnings could be reduced by factors like a 401k plan, retirement plan, or a cafeteria plan. The OASDI or Social Security component of FICA also has a cap. It may be further reduced by a cafeteria plan. On the other hand, the H I component of FICA, which is part of Medicare, does not have a cap. The major difference between the two types of wages for FICA taxes is that for the H I wage, we only reduce it by the cafeteria plan. Therefore, the difference between the Medicare wages and the total earnings is the cafeteria plan amount. In this example, the total earnings are $756.50 and the Medicare earnings are $506.50. So, the cafeteria plan amount would be $250. This represents a health insurance type plan. The calculation for Medicare tax involves determining the total for both the employer and employee portions of H I or Medicare. Then, we calculate each individual component and ensure that they match up. Starting with the total earnings for H I, which is $3,910.35, we multiply it by the rate of 1.45% or 0.0145. This gives us $56.70. For the employer portion, we calculate the H I wages multiplied by the...

Award-winning PDF software

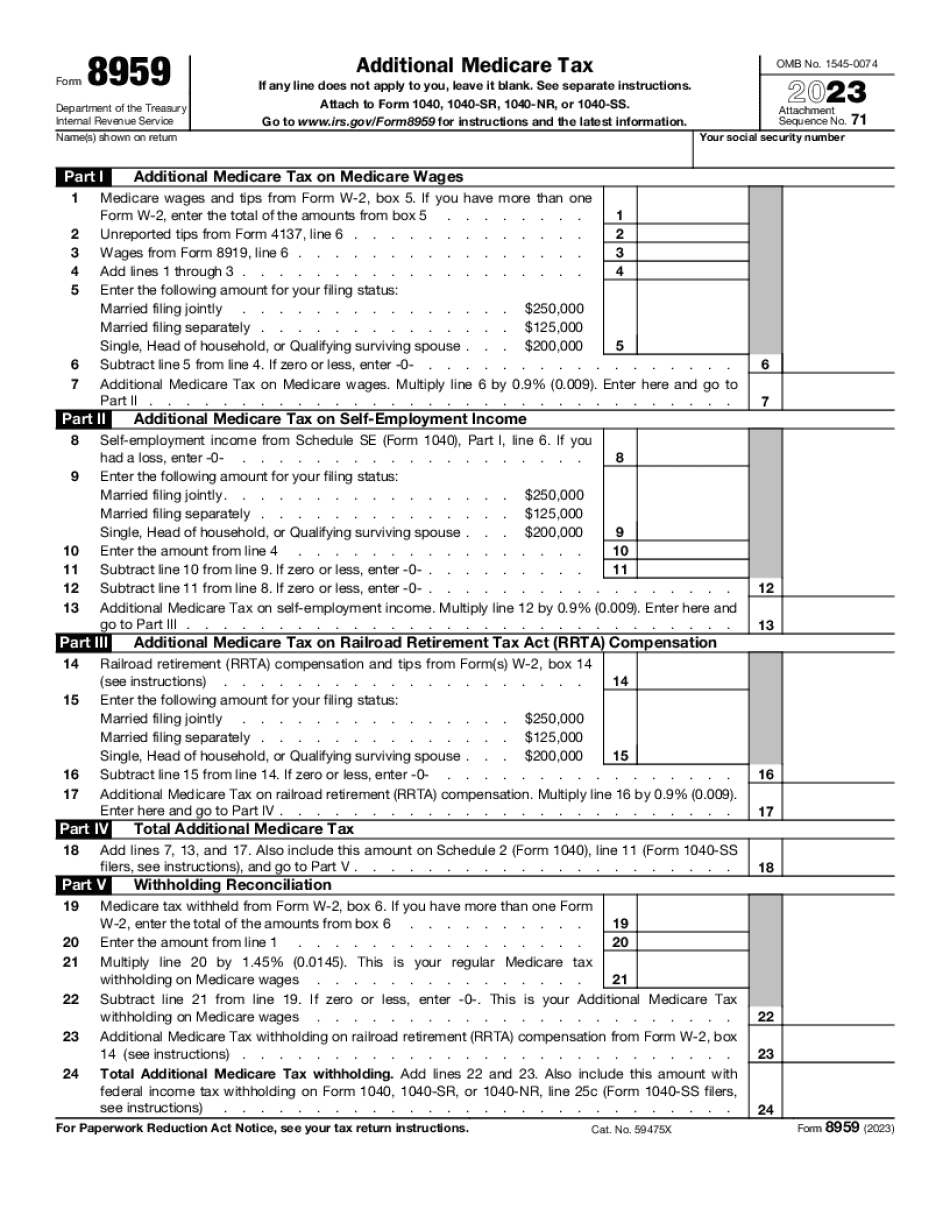

Additional Medicare Tax withholding Form: What You Should Know

If you are required to claim the Additional Medicare Tax on your Form 941, you may have to include the amount of your Additional Medicare Tax in your income as taxable income. You must include this amount on this year's return. Use Form 8959 and related forms or instructions and instructions provided by the Internal Revenue Service's (IRS) Information Services Division (ISD) at () and, the payment Solution website () to calculate and file any supplemental information to a tax return that requires an estimated Additional Medicare Tax. Other information may be available for your state from the IRS. The IRS has announced a public event (date/time TBA) on June 16, 2019, at noon EST, at 10:00 am. The event will include a question and answer forum with IRS employees. Income-Sharing Credit Most workers who receive employer-provided health care must use an employer-provided health coverage or pay a penalty. Most employers do NOT provide health insurance for their workers. You may also be able to receive medical care through a government plan such as Medicare, Medicaid, or TRI CARE. However, unless your employer provides medical care coverage, you must be self-sufficient. The credit is: Up to 35% of the total amount you paid for health care covered by your employer for calendar year 2024 that is not considered a qualified health plan. The amount you paid for health care is the portion of your wages for health benefits received from your employer and is determined each pay period. The credit for any year is 2,500. If you were paid 500 in wages in a year for 5,000 in wages in that year, the credit will be: 1,500 or 35 percent of the 5,000. Up to 15% of the total amount you paid in 2024 that is not considered a qualified health plan (5,000 in taxable wages). This credit is phased out with 35,000 in wages for 2018. Health Insurance Coverage The Affordable Care Act mandates that everyone will be required to have some form of health insurance coverage by 2024 or pay a penalty.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Steps to Fill out Digital 8959 , steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Steps to Fill out Digital 8959 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Steps to Fill out Digital 8959 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Steps to Fill out Digital 8959 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Additional Medicare Tax withholding