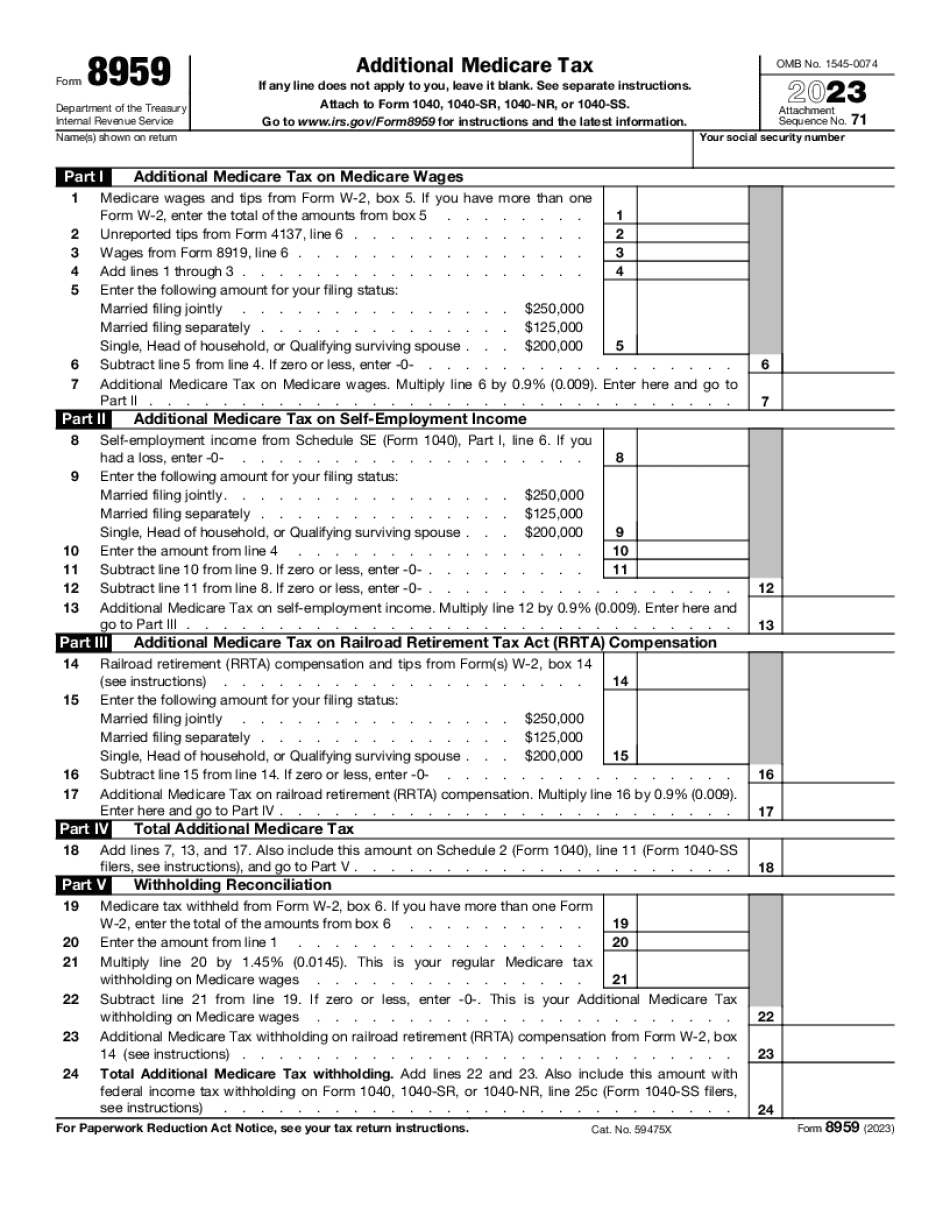

Welcome to downtown Fremont, California. My name is Ron Coan. I'm a tax partner with the firm of Greenstein Rogoff Olsen & Company, and this is our short little weekly tax update. Well, lots of things are going on. The tax season is starting to get into full swing, and I thought I'd mention a few issues. First, there is form 8960 regarding the net investment income tax on individuals. This is part of the Obamacare tax. If your income is over a certain level, you pay an additional three point eight percent of federal income tax. For many of our higher-income taxpayers, this has been a huge liability. We've been projecting it all through last year, and now it's coming due as people work through their forms. In some cases, there's planning that can be done to mitigate the impact, but it's a lot. We have several clients paying ten, twenty, fifty, a hundred thousand dollars of additional tax. So please make sure that you've worked through form 8960. Form 8960 kicks in if you are single and your adjusted gross income is over two hundred thousand dollars, or if you're married and your modified adjusted gross income, after certain adjustments, is over 250 thousand dollars. For most people, it's not an issue because their income is below those levels. But for a lot of high-income folks, it will come as a shock as to how much additional tax this creates. Additionally, there's form 89 59, the additional Medicare tax. This has also been in full swing throughout 2013, but now we're seeing the results on the tax returns coming due in April. If you're married and your income is over 250,000 or you're single and your income is over 200,000, there's an additional point nine of one percent Medicare...

Award-winning PDF software

8959 and 8960 Form: What You Should Know

Instructions for Form 8960 — IRS.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Steps to Fill out Digital 8959 , steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Steps to Fill out Digital 8959 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Steps to Fill out Digital 8959 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Steps to Fill out Digital 8959 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8959 and 8960