Hi, I'm Lin. I'm here to introduce you to Microsoft Word 2013 and how to create fillable forms. Forms are very helpful when we need to gather information from users such as job applicants, club members, or employees. With Microsoft Word, we can create forms that can be completed either in a printed hard copy version or an electronic version. The methods I will show you today can also be seamlessly applied to Microsoft Word 2010 and 2007. From planning and design to creation and protection, I will guide you through building simple and professional-looking forms. When planning and designing a form, there are a few initial questions to consider. Firstly, we need to determine what information should be collected from the user. The purpose of the form will usually dictate the information that needs to be gathered. For example, if it is a job application, we should include sections for personal contact information, job history, education, references, and special skill sets. If the form is for a club membership, we should include sections for personal contact information as well, but this time, maybe something like chapter location and committees they'd like to serve on. Sharing information on a form isn't always a one-way street. A form can also provide information to the applicant, such as membership dues, requirements, terms and conditions, and our company's mission statement. When designing the form, it is important to keep similar information together. For example, if we're requesting their name, address, and phone number, all of these should be located in one section on the form. Additionally, using headings like "Personal Information" can make it clear as to what information we're asking for. We should also keep in mind how the form will be distributed, whether it is in print or electronic format. When the form is...

Award-winning PDF software

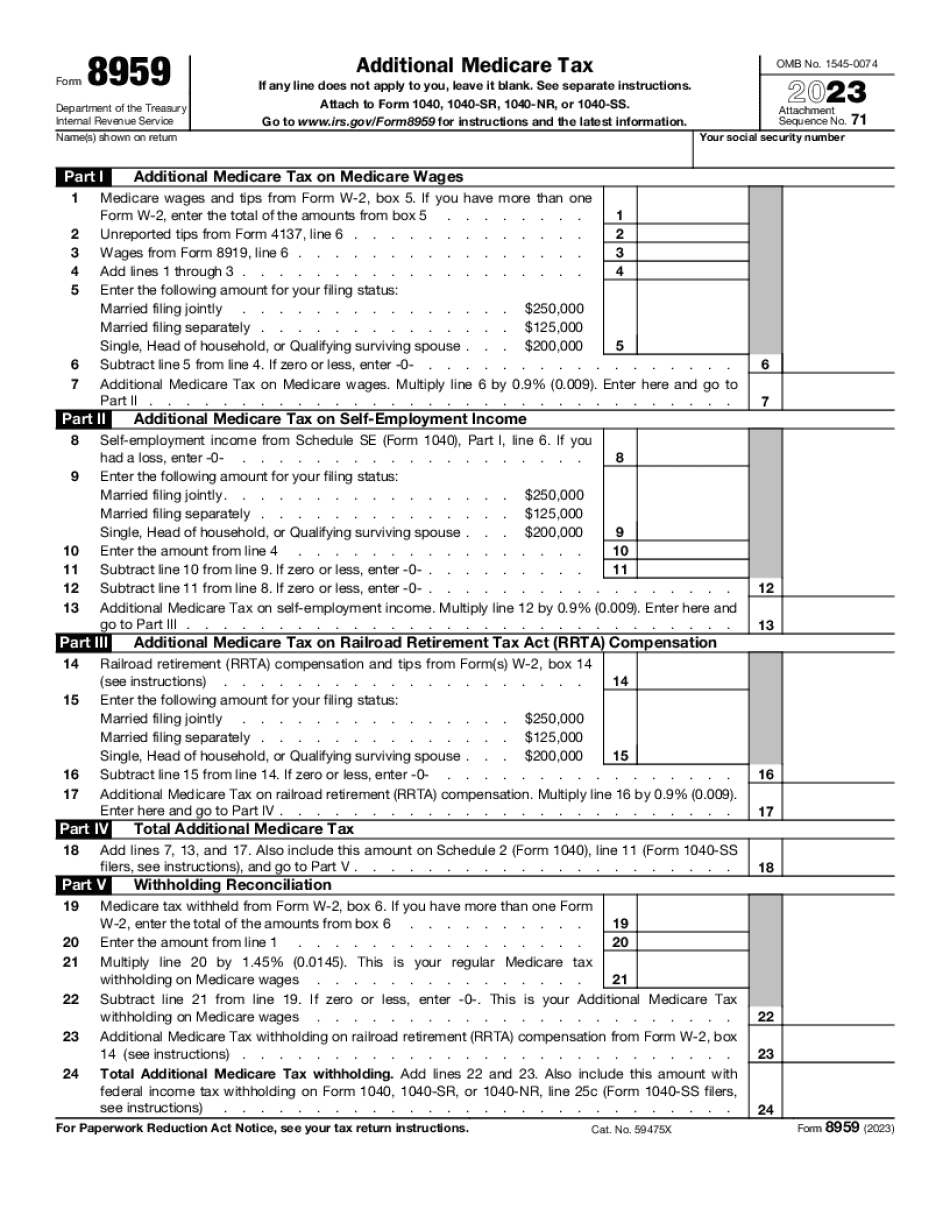

How to fill Steps to Fill out Digital 8959 Form: What You Should Know

All areas are completed in full if the form is completed online. Some areas, such as Form 8959, do not require a physical or electronic submission. Step 1. Complete a new tax return, Form 1040X. If W-2 income for 2024 was 1,500 or less, it can be estimated that you will not be subject to an additional Medicare tax on self-employment income. If your annual wages and self-employment earnings exceed 2024 income thresholds, enter the following on line 13 of your Form 1040X return: the Additional Medicare Tax that applies with a check or other amount (the IRS tells us to include the 0 threshold on line 2 as part of the Form 8959 calculation); the Social Security tax (which you're already paying); and the Medicare Parts A and B (Forms 1095 and 1096) in box E on line 1 of your 1040. Also complete line 5 of Form 1095 (Form 1096 is not required on this line). The extra line 5 also counts toward the additional Medicare tax threshold on your return. As you can see, your Form 1040 must contain the checkbox indicating you plan to file an additional Medicare Tax on your self-employment income under instructions on line 8. You must also declare itemized deductions on line 14, including the “income with respect to which you paid special rules on Form 8959”. If your Form 1040X does not include line 1, fill the extra line. Step 2. Complete additional lines of Form 1040X. Line 7. Enter the self-employment tax amount on line 13. The total is estimated and should add up to 49 (0.019 × 3). Line 8a. Enter the additional Medicare tax amount that you are subject to on line 13. The total is estimated and should add up to 51 (0.0019 × 3). If additional line 8a includes your Social Security taxes, or if the amount of income with respect to which you paid special rules on Form 8959 for 2024 is 1,500 or less, include your Social Security taxes on line 8a. If your Form 1040X does not include line 8a, check the boxes in line 8 of Form 1040. Enter the Social Security or Medicare taxes paid. Add line 22, for self-employment tax on income from sources other than self.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Steps to Fill out Digital 8959 , steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Steps to Fill out Digital 8959 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Steps to Fill out Digital 8959 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Steps to Fill out Digital 8959 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to fill Form Steps to Fill out Digital 8959